Whether you’re saving for a down payment on a home, your retirement or to help finance college tuition, a term account, similar to a certificate of deposit (CD), may offer an attractive and stable growth opportunity for your money. These accounts are popular for a wide range of investors from all income levels as a means to help realize both long- and short-term savings goals.

Term Accounts vs. Traditional Savings Accounts—What’s the Difference?

Term accounts allow you to enter into a contract with a financial institution to receive a higher rate of return, or interest, on your money than you would in a savings account. As part of this contract, you are obligated to leave your funds in the account until it reaches the end of the agreed upon timeframe, or maturity date. Most financial institutions offer term accounts for periods ranging from several months to five years or more. Often, the rate of return will vary based on the length of the term.

One of the main differences between a term and a savings account is that you are not able to make withdrawals against your term account before the end of the defined period without incurring a penalty.

How a Term Account Can Help You Reach Your Savings Goals

Let’s assume that you plan to purchase a home five years from now and you want to tuck away $25,000 to help with a future down payment. What type of dividends (credit union speak for “interest” or return), could you expect to see if you placed this $25,000 in a savings account versus a term account?

In the below example, you can see the differences in annual percentage yield (APY) for each type of account. APY includes the interest you would receive each year based on both the initial $25,000 deposit, or principal, as well as the compounded amount of the accumulated monthly interest.

–Savings account value after five years with initial $25,000 investment:

- APY: 1.0% (average current rate for savings accounts)

- Account value at the end of five years: $26,281.00

- Total interest earned: $1,281.00

–Term account (similar to a CD) value after five years with initial $25,000 investment:

- APY: 2.8% (average current rate for a five-year, $25,000 term account, compounded monthly)

- Account value at the end of five years: $28,752.00

- Total interest earned: $3,752.00

Based on this example, you would earn nearly three times the dividends in a term account as you would in your savings! To learn more about how much you could save with either a term account or savings account, access our online simple savings calculators.

Are Term Accounts (Similar to CDs) Right for You?

There is no one-size-fits-all solution to financial planning, and term accounts aren’t necessarily the right answer for everyone. However, many choose term accounts over traditional savings for:

- Higher dividend rates: Term accounts typically offer a much higher percentage of return than savings accounts.

- Security: Funds deposited in term accounts are insured up to at least $250,000 by the National Credit Union Administration (NCUA). Both the NCUA and FDIC are backed by the full faith and credit of the U.S. government. In addition, if interest rates were to fall during the period of your term account, your funds would be locked in at a higher rate.

- Lower risk: Term accounts offer relatively low levels of risk compared to investments like stocks, bonds and mutual funds, which can decrease in value and are not federally insured.

Some of the downsides of choosing a term account over a savings account could include:

- Not suitable for emergencies: The funds in a term account are considered locked in and, therefore, are not readily accessible in case of an emergency.

- Early withdrawal fees: If you needed to withdraw the funds early, you could incur penalties. The issuing financial institution should clearly state these penalties up front.

- Interest rates may rise during the term of your term account: If interest rates rose during the period of your term account, you would need to wait until it reached maturity to cash it in and reinvest the funds to take advantage of the higher rates (or, incur penalty fees).

“Ladder” Term Accounts to Maximize Flexibility

“Laddering” is a savings strategy that overcomes some of the liquidity disadvantages of a term account while still helping you maximize returns. Laddering occurs when you stagger the length of your term accounts, giving you the ability to cash them out and convert them to liquid assets at planned intervals.

An example of laddering your term accounts would be purchasing five separate term accounts at $5,000 each instead of one for $25,000. You would then break them down into the following ladder structure each with a different term:

- #1 Term Account: $5,000 for a one-year term

- #2 Term Account: $5,000 for a two-year term

- #3 Term Account: $5,000 for a three-year term

- #4 Term Account: $5,000 for a four-year term

- #5 Term Account: $5,000 for a five-year term

By using this strategy, you would have a window each year to access some of your money, if needed. Also, if interest rates started to rise, you would be able to cash in a term account after it matured and then purchase a higher interest term on the next term account. If interest rates fell, you would still have your five-year term account locked in at the higher rate.

Considerations Before Opening a Term Account

Before opening a term account, be sure to read the terms and conditions carefully, and ask the following questions:

What is the best rate you can lock in for the investment term?

Shop around to find a competitive rate by comparing financial institutions’ APY. Remember, the APY, or amount of compounded interest you’ll earn in a year on both the principal investment as well as the previous interest you’ve earned, is different from the Annual Percentage Rate (APR). The APR is most often used when discussing loans or credit card interest and refers to just the simple interest rate multiplied by the number of periods in a year. Even if the term account you’re interested in is for less than a one-year period, the APY process of compounding interest is still applicable for comparison purposes.

What is the current interest rate environment?

Do your homework to see what financial experts are saying about the likelihood that interest rates may change. If rates are expected to climb, a short-term account may be your best option. If rates are projected to fall, locking in a longer-term term account right now may be in your best interest.

How often are dividends credited?

Dividends (interest) are most often credited monthly and should appear on your online or paper account statement.

When will you receive dividends on a term account?

The total amount of dividends you accumulate will pay out on the maturity date of the term account. Most financial institutions will provide you advanced notice around 30 days before the term maturity date to give you time to consider your options.

What happens after your term account matures?

When your term account reaches the end of the initial term, you will usually have a 7-10 day grace period to move your money out of the term account or reinvest it. After this grace period, your term account may automatically renew in what is known as a rollover. Less likely, but still a possibility, is for the funds to be deposited into a savings account, so it’s important to understand what will happen at maturity. If the term account was a promotional product, also understand what account into which it will roll over.

How will you be penalized for making an early withdrawal?

Early termination fees vary based on the length of the term account but often range from three months to one year of accumulated interest.

Minimum deposit amounts:

Most financial institutions require you to invest a minimum of $500 – $1,000 to open a term account.

Term Account Calculator

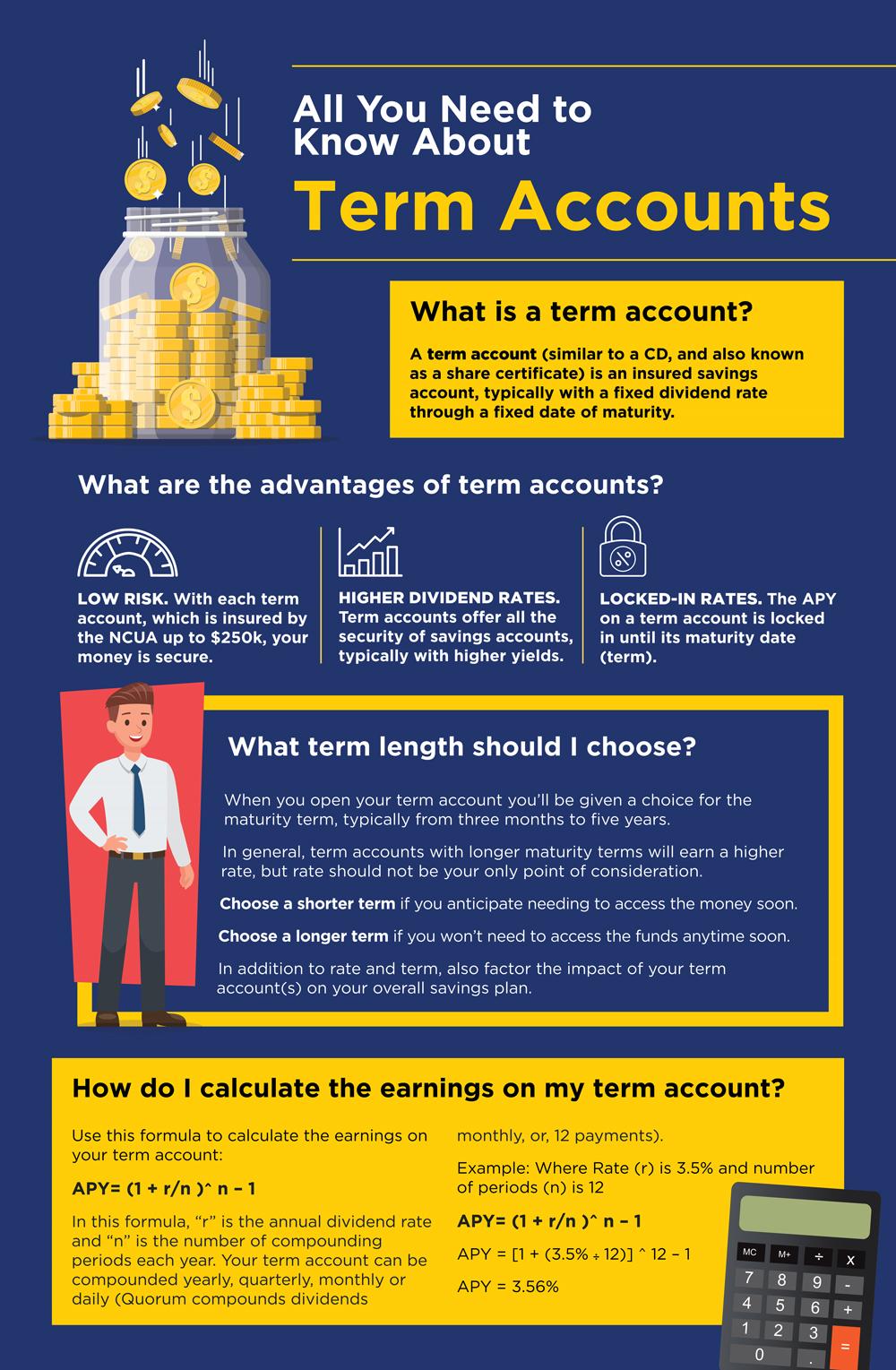

If you don’t want to use the formula in the infographic above to calculate the earnings on your term account, use this handy term account calculator to help you determine earnings.

After you’ve mapped out your savings goals and done your homework by addressing the questions above, you are ready to start shopping for a great rate, and open your term account. Depending on the financial institution you choose, you may be able to open and fund it online! Get started today and set yourself on a path to reach your savings goals!

Comments Section

Please note: Comments are not monitored for member servicing inquiries and will not be published. If you have a question or comment about a Quorum product or account, please visit quorumfcu.org to submit a query with our Member Service Team. Thank you.